Axelar to lead the charge in cross-chain interoperability growth

Axelar seeks to address challenges in decentralized applications and protocols, Flipside’s new cross-chain report revealed.

Despite the challenges facing cross-chain adoption, as only 13% of Ethereum Virtual Machine (EVM) addresses have transacted across chains, Axelar’s recent innovations could soon transform this sector.

The key to Axelar’s appeal lies in its cornerstone features: the Interchain Token Service (ITS) and General Message Passing (GMP). The tools simplify developers’ process of building decentralized applications (dApps) that function across multiple blockchains, making Axelar a seamless framework for multichain applications.

ITS automates the creation of tokens that work natively across supported EVM chains, eliminating the need for complicated bridging processes. GMP, meanwhile, enables developers to call functions across protocols, effectively making cross-chain interoperability as simple as developing on a single chain.

Axelar’s cross-chain solution appears to be resonating with developers and users alike. On-chain data reveals that Axelar has experienced rapid GMP and ITS usage growth, expanding by over 31,000% since October 2023.

The solution now boasts over 270,000 unique users, indicating that Axelar is gaining traction among the broader crypto community. Its presence in the Ethereum ecosystem is particularly noteworthy, having surpassed competitors like Wormhole and LayerZero in terms of usage.

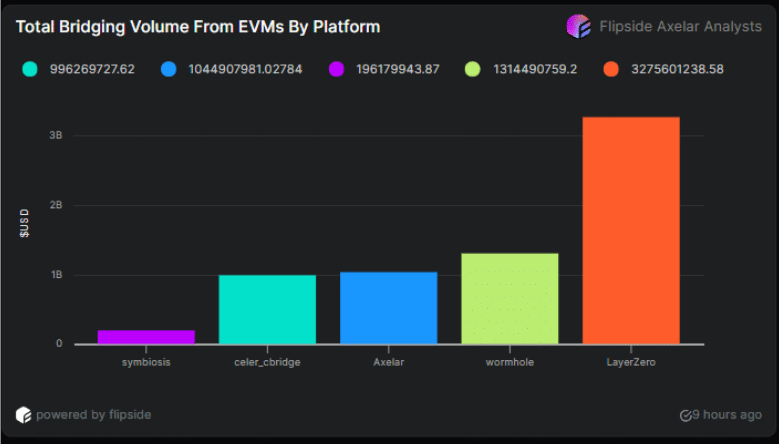

Despite trailing LayerZero and Wormhole in total bridging volume, Axelar continues to build a strong foothold in cross-chain competition.

While LayerZero currently leads with over $3 billion in bridging volume, Axelar has steadily secured its position just behind Wormhole, with over $1 billion in volume. Its bridging volume could be underestimated due to non-EVM chains in Axelar’s ecosystem, which are not fully captured in data comparisons.

One factor driving Axelar’s sustained growth is the Squid Router, a cross-chain swap engine that facilitates most GMP transactions. With over $830 million in bridging volume, Squid integrates with leading decentralized exchanges like dYdX and PancakeSwap, providing efficient cross-chain swaps and conversions.

Squid’s presence is reflected in Axelar’s growth charts, closely mirroring the rise in GMP and ITS usage, indicating that its capabilities are a critical part of Axelar’s success.

Axelar has also positioned itself as a secure and decentralized solution, addressing concerns that plague many cross-chain protocols. With a fully decentralized validator set of over 75 validators, Axelar contrasts sharply with LayerZero’s reliance on oracles and Wormhole’s permissioned validator set.

Moreover, the report also emphasized that Axelar’s focus on accessibility ensures that developers can easily adopt a multichain-by-default strategy, helping dApps overcome the challenges of cross-chain functionality.

The report stated, “For now, centralized onboarding handles most cross-chain activity. But when the right decentralized option matures, we may be in for an era of massive growth for interoperability protocols, starting with Axelar.”